In a notable departure from the statewide outcome, Ware County was one of just four counties in Georgia that did not pass the Floating Local Option Sales Tax (FLOST) during the November 4, 2025, election.

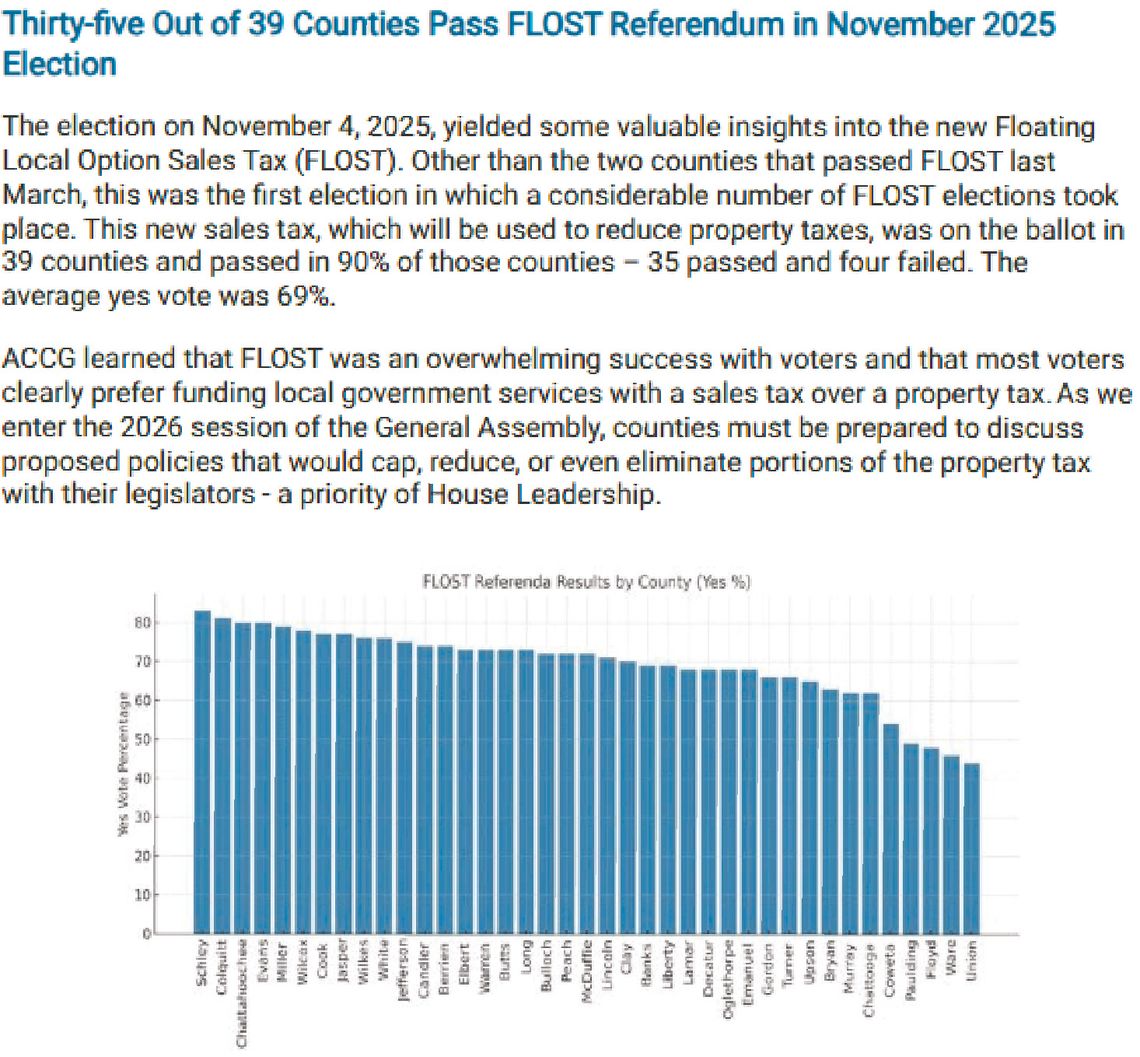

While 35 of the 39 counties with FLOST on the ballot approved the measure — yielding an average “Yes” vote of 69 percent statewide — Ware County voters opted against the proposed sales tax, which was designed to offset property taxes.

According to official results, Ware County voted 1,742 in favor (45.83 percent) and 2,059 against (54.17 percent), narrowly defeating the referendum. The FLOST proposal would have allowed the county to implement a flexible sales tax to reduce reliance on property taxes and fund essential local services.

The referendum marked a pivotal moment in Georgia’s evolving approach to local government funding.

The Association County Commissioners of Georgia (ACCG) reported strong voter support across most counties, signaling a growing preference for consumption-based taxes over property levies.

Despite this momentum, Ware County’s rejection reflects either skepticism about the tax’s impact or concerns about its implementation.

Without FLOST, Ware County will continue to rely on traditional property tax revenues, even as neighboring counties begin exploring reductions or caps in those rates.

The ACCG has indicated the 2026 session of the Georgia General Assembly may consider legislation to further shift the tax burden from property to sales, making Ware County’s decision especially consequential.

Local officials and community leaders now face a complex fiscal landscape and may need to revisit the issue in future elections.

As the state moves toward broader property tax reform, Ware County residents and officials will need to engage in renewed dialogue about funding priorities, equity, and the long-term sustainability of local services.